Singapore is a paradise for condo lovers. From luxurious sea-facing apartments to reasonably priced riverfront homes, the city-state has something for everyone. Condos are a popular choice not only among locals but also expats who find them a convenient option for living in Singapore. If you’re one of them, you might have already started exploring condo loans to finance your dream home in Emerald of Katong or any other condo development in Singapore. If you have, register now. But of course, financing your condo might not be the easiest ride, especially if you choose a mortgage. While lenders are there to help you finance your property, they might not reveal everything you need to know about the fine print. So, before signing on the dotted line, let’s uncover what banks don’t tell you about condo loans in Singapore.

Prepayment Penalties

Prepayment penalties can catch many borrowers off guard. These fees are charged when you pay off your loan earlier than agreed. While it may seem like a good idea to eliminate debt quickly, banks often impose these penalties as a way to secure their expected interest income. The amount of the penalty varies by lender and can significantly impact your financial plans. Some lenders might charge a percentage of the remaining balance, while others have fixed amounts outlined in your loan agreement. It also means reading the fine print carefully before committing to any loan terms. Understanding how prepayment penalties work will allow you to make informed decisions about refinancing or paying down your mortgage early without incurring extra costs that could diminish savings over time.

Loan Tenure Limitations

Aside from that, loan tenure limitations can be a tricky aspect for buyers. Most banks offer tenures ranging from five to thirty years. This might sound flexible, but the choices are often more constrained than they appear. A shorter tenure means higher monthly repayments, which can strain your budget. On the flip side, longer tenures lower those payments but increase the total interest paid over time. Moreover, different lenders have varied policies based on age and retirement plans. If you’re nearing retirement age, you may face stricter limits that affect your borrowing capability.

LTV (Loan-to-Value) Restrictions

Now, let’s talk about LTV restrictions. These restrictions dictate how much you can borrow against the property’s value. Typically, for first-time homebuyers, banks allow up to 75% of the property’s purchase price or market valuation—whichever is lower. This means you’ll need a significant down payment. If you’re buying additional properties, be prepared for tighter LTV limits. The regulations tighten as you accumulate more real estate assets. This impacts your financial planning and cash flow significantly. Knowing these details upfront can prevent surprises later on. Lenders assess your financial profile before determining your specific LTV ratio. Factors like income stability and existing debts play vital roles in this evaluation process.

Lock-in Periods

Lock-in periods can also catch many condo buyers off guard. This is the time frame during which you cannot refinance or pay off your …

A reputable precious metals dealer should have a clearly defined buyback policy outlining the terms and conditions for selling your precious metals back to them. Evaluate the dealer’s buyback rates, fees, and procedures to ensure a fair and transparent process. Additionally, assess their customer support services, including assistance with account management, market updates, and prompt resolution of any issues that may arise. Finding a reputable dealer is key to a successful and secure transaction when investing in or selling precious metals.

A reputable precious metals dealer should have a clearly defined buyback policy outlining the terms and conditions for selling your precious metals back to them. Evaluate the dealer’s buyback rates, fees, and procedures to ensure a fair and transparent process. Additionally, assess their customer support services, including assistance with account management, market updates, and prompt resolution of any issues that may arise. Finding a reputable dealer is key to a successful and secure transaction when investing in or selling precious metals.

It never hurts to try negotiating your bills with service providers or creditors. You might be surprised at their willingness to work out a payment plan that fits your budget. It could save you money in the long run by avoiding expensive late fees and interest charges. In conclusion, by following these seven tips, you can prepare for unexpected expenses and rest a little easier knowing that you won’t be left scrambling for cash when the unexpected happens. Taking the time to plan will help ease financial stress in times of hardship. With careful planning and monitoring, you can ensure you are ready for anything life throws your way.…

It never hurts to try negotiating your bills with service providers or creditors. You might be surprised at their willingness to work out a payment plan that fits your budget. It could save you money in the long run by avoiding expensive late fees and interest charges. In conclusion, by following these seven tips, you can prepare for unexpected expenses and rest a little easier knowing that you won’t be left scrambling for cash when the unexpected happens. Taking the time to plan will help ease financial stress in times of hardship. With careful planning and monitoring, you can ensure you are ready for anything life throws your way.…

According to the above study, the average household owes over $130,000 in debt. It can be a major cause of stress for families. If you’re considering taking on any kind of debt, it’s vital to understand the implications and make sure you can handle the payments. If you’re struggling with debt, resources are available to help you get back on track. The most important thing is to stay informed and make a plan that works for your family.

According to the above study, the average household owes over $130,000 in debt. It can be a major cause of stress for families. If you’re considering taking on any kind of debt, it’s vital to understand the implications and make sure you can handle the payments. If you’re struggling with debt, resources are available to help you get back on track. The most important thing is to stay informed and make a plan that works for your family. Before taking on any debt, it’s important to understand the implications. They include understanding the interest rates, repayment terms, and your overall financial picture. You can use tools like a debt calculator to help you understand the implications of taking on debt. It can be a helpful way to see how much your payments will be and how long it will take you to pay off the debt. It’s also important to remember that household debt is not just about the money you owe. It’s also about your credit score and your ability to get loans in the future.

Before taking on any debt, it’s important to understand the implications. They include understanding the interest rates, repayment terms, and your overall financial picture. You can use tools like a debt calculator to help you understand the implications of taking on debt. It can be a helpful way to see how much your payments will be and how long it will take you to pay off the debt. It’s also important to remember that household debt is not just about the money you owe. It’s also about your credit score and your ability to get loans in the future. Not all debt is created equal. There are different types of household debt, and each has its own set of implications. The most common types of household debt are mortgage debt, student loan debt, and credit card debt. Mortgage debt is usually the largest type of debt that families have. This debt is typically spread out over a long period, and it usually has lower interest rates. Student loan debt is another common type of debt, and it can be difficult to repay if you don’t have a steady income. Credit card debt is often the most expensive type of debt, and it can be easy to get into if you’re not careful.

Not all debt is created equal. There are different types of household debt, and each has its own set of implications. The most common types of household debt are mortgage debt, student loan debt, and credit card debt. Mortgage debt is usually the largest type of debt that families have. This debt is typically spread out over a long period, and it usually has lower interest rates. Student loan debt is another common type of debt, and it can be difficult to repay if you don’t have a steady income. Credit card debt is often the most expensive type of debt, and it can be easy to get into if you’re not careful.

Don’t forget about the little ones in your life, be sure to include them on your list of people you need to buy for this holiday season. Include some special gifts that’ll make their eyes light up, just like when they open presents with all their family around.

Don’t forget about the little ones in your life, be sure to include them on your list of people you need to buy for this holiday season. Include some special gifts that’ll make their eyes light up, just like when they open presents with all their family around.

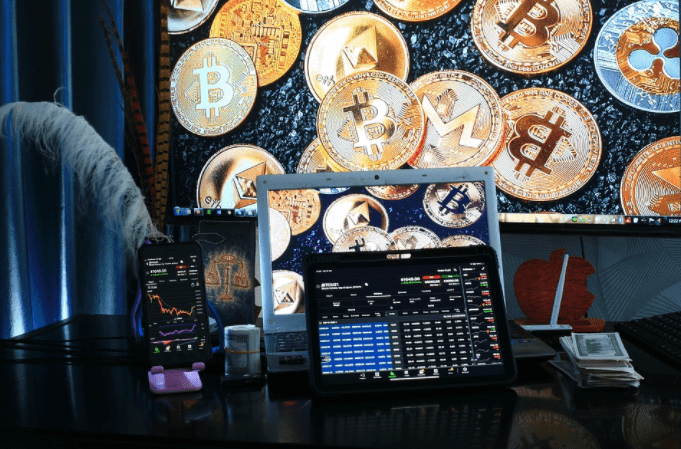

There’s always a hot tip or a sure thing in cryptocurrencies. Block X has assembled a team of industry experts dedicated to finding the best investment opportunities. You can create your due diligence checklist if you want to invest in cryptocurrencies on your own. Does the team exist? Check their LinkedIn presence to make sure they are a legitimate and experienced player in the cryptocurrency space.

There’s always a hot tip or a sure thing in cryptocurrencies. Block X has assembled a team of industry experts dedicated to finding the best investment opportunities. You can create your due diligence checklist if you want to invest in cryptocurrencies on your own. Does the team exist? Check their LinkedIn presence to make sure they are a legitimate and experienced player in the cryptocurrency space.

You should make sure you keep track of where your money goes, comes in, and how much you spend on it. There are several unique ways to do this. If you only have a few trades per month, then you probably need to create a concise group in the format that suits you best. You can also purchase a ledger and record your accounts the traditional way on paper. You can purchase specialized accounting software, but if you’re a small business with a few trades, it’s probably not worth it.

You should make sure you keep track of where your money goes, comes in, and how much you spend on it. There are several unique ways to do this. If you only have a few trades per month, then you probably need to create a concise group in the format that suits you best. You can also purchase a ledger and record your accounts the traditional way on paper. You can purchase specialized accounting software, but if you’re a small business with a few trades, it’s probably not worth it.