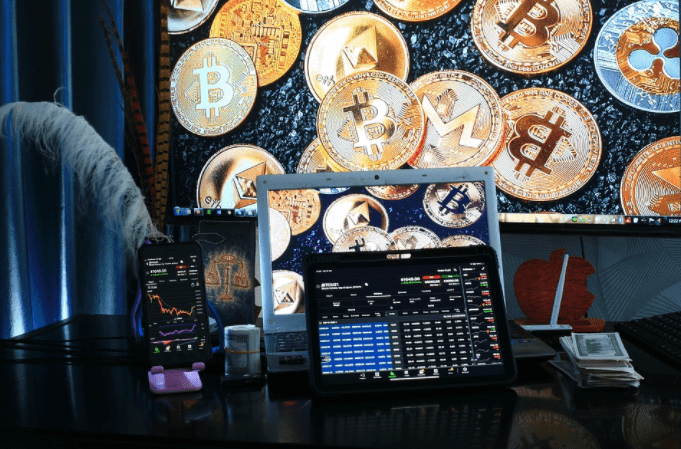

There’s no doubt that cryptocurrencies have created a new investment market. With Bitcoin valued at over $19,000, cryptocurrencies are a hot topic for investors, consumers, and the mainstream media. Savvy investors tend to invest in high-risk, high-yield opportunities. However, investing in cryptocurrencies comes with unique risks. But, you can learn those potential risks and avoid them by joining ‘The Plan’, a special course of cryptocurrency by Dan Hollings. You can read a review from his successful pupil, marcus lim.

Although cryptocurrencies are gaining in popularity, cryptocurrency regulation is not keeping pace. A country can impose restrictions on cryptocurrencies, which can negatively affect their value. While investing in cryptocurrencies can offer significant benefits, consumers need to educate themselves before making a decision. While many cryptocurrency companies can offer substantial returns, investors need to identify suitable opportunities among many offerings. Here are the five most important things to know before investing in cryptocurrency.

Do Some Research

There’s always a hot tip or a sure thing in cryptocurrencies. Block X has assembled a team of industry experts dedicated to finding the best investment opportunities. You can create your due diligence checklist if you want to invest in cryptocurrencies on your own. Does the team exist? Check their LinkedIn presence to make sure they are a legitimate and experienced player in the cryptocurrency space.

There’s always a hot tip or a sure thing in cryptocurrencies. Block X has assembled a team of industry experts dedicated to finding the best investment opportunities. You can create your due diligence checklist if you want to invest in cryptocurrencies on your own. Does the team exist? Check their LinkedIn presence to make sure they are a legitimate and experienced player in the cryptocurrency space.

Can you open up the company’s source code? To examine the entire collection of source code, you should read the codebase: does it address a real problem, or is it simply a knockoff? Is the company managing a potential area, or is it copying an existing offering? Does the company have a proof of concept? If the company has a proof of concept and a beta version, there’s a better chance your investment will pay off as the company matures.

Take Any Responsibility and Keep Being Realistic

While cryptocurrencies are a good fit for any portfolio, they should be considered high-risk investments. To mitigate extreme risks, you can invest 10-20% of your portfolio in cryptocurrencies. However, it is essential to make sure your portfolio is well diversified.

The hype around cryptocurrency purchases says that they will lead to wealth and make you 1000% richer. This has happened before and could happen again. However, this is not a sound investment strategy. You have to be realistic when investing. Remember the .com boom, which produced many of the most valuable companies with the largest market capitalization of all time, but many others, if any, lost.

Be Vigilant

While security and hacking are reasonable concerns, many can be avoided, even those without the technical expertise. You can be vigilant in choosing the right company to manage your investments. If you choose a company like Block X, your investments will be safe with a trusted team committed to extreme care.

Keep these things in mind when investing on your own. Private keys must be kept secret and not shared. Also, only use trusted wallets and exchanges. Inquire about the institutions that hold your …