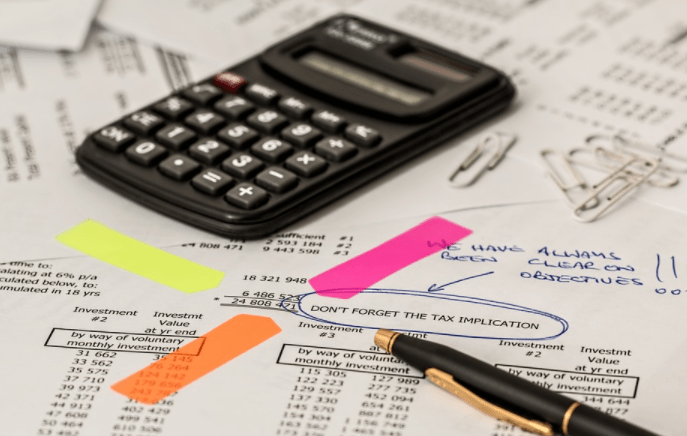

If you are self-employed, you probably realize that you need to adapt your financial management as you don’t work under someone’s business. These financial management habits will ease you in managing your money and your cash-flow of your own business. You can read more about these habits at http://www.businessanalystlearnings.com/business-matters/2020/11/20/4-steps-to-making-self-employment-work-for-you. Furthermore, an accounting professional advised me to not show up with a bunch of unexpected bills and expenses, with amounts that bear no relation to what our statement says coming in and going out. Instead, you should follow these tips below.

Create Clear Boundaries Between Personal and Business Funds

Open another account for your business. If you’re a sole proprietor, there’s no legal requirement to do this, but it makes it easier to keep track of your business’ expenses and income. Before opening a new account, look for the best deals. So, if your business is small and you’re a sole proprietor, instead of opening a separate small business account, you’ll probably open a second standard personal business account. Most business accounts have monthly fees and transaction charges, but personal checking accounts are not free.

Record All In-Goings and Outgoings

You should make sure you keep track of where your money goes, comes in, and how much you spend on it. There are several unique ways to do this. If you only have a few trades per month, then you probably need to create a concise group in the format that suits you best. You can also purchase a ledger and record your accounts the traditional way on paper. You can purchase specialized accounting software, but if you’re a small business with a few trades, it’s probably not worth it.

You should make sure you keep track of where your money goes, comes in, and how much you spend on it. There are several unique ways to do this. If you only have a few trades per month, then you probably need to create a concise group in the format that suits you best. You can also purchase a ledger and record your accounts the traditional way on paper. You can purchase specialized accounting software, but if you’re a small business with a few trades, it’s probably not worth it.

It’s especially easy to get rid of cash receipts and prize records because you don’t have a backup of the files on your bank statement. Be sure to record the cash you invest or receive in your spreadsheet or post to the accounting bar. Then, bill the cash to which it relates. A very simple approach to keeping track is to pay every cash that comes into your bank accounts.

Get Your Receipts Organized

For excellent bookkeeping in your self-employment, you should keep copies of receipts for your expenses in an organized manner. Don’t write receipts on the back of your jeans! Keep receipts in an organized manner. Here are some excellent tactics on how to do this. If you have small receipts, staple them to an A4 sheet of paper and record or scan them to prevent modest pieces from getting lost or dropped. Ultimately, if it is not obvious what you purchased at the reception or the business’s purpose, write a note on the receipt.

Include All of Your Expenses

You should include all of your business expenses. You can find information on expenses that can be claimed on the UK government website. If you work from home, you may want to include some of the costs of running your home. In this case, your meter may need …