They received their “commendable” name for the elegance of their product’s expression and increased chemical resistance. You can read this complete guide to know more about investing in metals.

Gain More Profits

The traditional approach of investment experts thinking about buying gold bars and the appearance of “gold” investors in the expensive metals market is directly related to the historical fact of the visual attraction of precious metals in the system of relationships between commodities and money. So far, gold bars have been invested not only by large banks but also by brokerage firms and investors. However, this approach requires a relatively large amount of capital, making it inaccessible to people with high and low incomes. Because of their reasonably decent cost, currencies could be considered a viable alternative for this type of increase in investment returns. They are ensuring that these currencies can buy and sell at any time, which can be an additional reason for these investments’ benefit and success.

These alternative financial instruments and commodity transactions with the help of an expert plan will allow you to invest in precious metals at the best market price and thus get a guaranteed amount. One of the most common ways to invest in expensive metals today is the cost of guaranteed gold securities. This type of investment has undoubted advantages, one of which is the absence of commissions on real gold purchase. Another modern and popular type of investment is the discovery of so-called metal accounts. In these cases, the investment is a part of the alloy with a coordinated and unified version, which the lender sells at market price. The purchase of expensive metals describes the long-term possibilities of raising funds. However, it would help if you did not forget that there are periods of prolonged stagnation and short-term recovery of the current market, which are the starting point for your property buyer to invest cash or make a profit.

These alternative financial instruments and commodity transactions with the help of an expert plan will allow you to invest in precious metals at the best market price and thus get a guaranteed amount. One of the most common ways to invest in expensive metals today is the cost of guaranteed gold securities. This type of investment has undoubted advantages, one of which is the absence of commissions on real gold purchase. Another modern and popular type of investment is the discovery of so-called metal accounts. In these cases, the investment is a part of the alloy with a coordinated and unified version, which the lender sells at market price. The purchase of expensive metals describes the long-term possibilities of raising funds. However, it would help if you did not forget that there are periods of prolonged stagnation and short-term recovery of the current market, which are the starting point for your property buyer to invest cash or make a profit.

Get More Value

Since 2005, Michael Maloney has been Robert Kiyosaki’s’ advisor for investments in precious metals. Mike is not just a brilliant person; he is a smart person who is aware of what shapes our economy and cares about influencing the middle class. In this book, Mike outlines the history of money, money, and the boom and bust cycles that coins go through. It begins with the first monetary collapse in ancient Greece in 680 BC. He cites several historical examples that demonstrate the same thing: currencies are not real money. They are generally used by governments to exploit the value of their taxpayers’ hard work. Over the centuries, many things like cattle, spices, grain, and paper have served as money, but two things have always been real money, gold, and silver.

The novel’s impact lies in its simple but comprehensive explanations of how to understand the Dow’s real value compared to raw materials, land, and precious metals. In times of financial turmoil, wealth does not evaporate; it merely moves from one group to another. In this …

Before deciding the vehicle short term advance business to choose, please make a point to check for how trustworthy they are. What are people saying about these? Before applying for a formal notice advance, you need to consider if the

Before deciding the vehicle short term advance business to choose, please make a point to check for how trustworthy they are. What are people saying about these? Before applying for a formal notice advance, you need to consider if the  Continuously your car short term advance is allowed for you, and your interest starts tallying. Because you wouldn’t have to have the financing costs to keep, including, you will need to reimburse your credit before the due date to spend less. You have to ensure your moneylender won’t rebuff you for making a recorded reimbursement before consenting to sign your advance off. This methodology contrasts, starting with one bank then onto the next. All through your application methodology, guarantee your moneylender will permit you to keep up your vehicle. A few moneylenders will require your car to keep their proprietorship until you may reimburse your credit. Even though this training has impressively diminished, you need to affirm. Car title loans might be the ideal option for most people when they’re defied with a financial issue. It is better to be prepared of what you’re calling yourself in before applying to your short term credit.

Continuously your car short term advance is allowed for you, and your interest starts tallying. Because you wouldn’t have to have the financing costs to keep, including, you will need to reimburse your credit before the due date to spend less. You have to ensure your moneylender won’t rebuff you for making a recorded reimbursement before consenting to sign your advance off. This methodology contrasts, starting with one bank then onto the next. All through your application methodology, guarantee your moneylender will permit you to keep up your vehicle. A few moneylenders will require your car to keep their proprietorship until you may reimburse your credit. Even though this training has impressively diminished, you need to affirm. Car title loans might be the ideal option for most people when they’re defied with a financial issue. It is better to be prepared of what you’re calling yourself in before applying to your short term credit.

This is only one of the greatest plans which you ought to embrace for one to become debt-free. This should be of attention if you’re serious about your debt direction. Attempt to squeeze each cost to the minimum level. Prevent luxury spending whenever you’re in a debt management scenario. Spending on items like vacation and entertainment travels ought to be regarded as hindrances in this situation. Make sure your needs and demands are distinguished. This will certainly test your seriousness and dedication so far as eliminating debt is worried.

This is only one of the greatest plans which you ought to embrace for one to become debt-free. This should be of attention if you’re serious about your debt direction. Attempt to squeeze each cost to the minimum level. Prevent luxury spending whenever you’re in a debt management scenario. Spending on items like vacation and entertainment travels ought to be regarded as hindrances in this situation. Make sure your needs and demands are distinguished. This will certainly test your seriousness and dedication so far as eliminating debt is worried.

This can seem somewhat odd, yet it is so correct. You may change how you see every coin or cent you spend. You attracted to quality, value, and debating whether its a need or want. You might delay a purchase over instinct, which is a calming change, especially if you bought items over impulse.

This can seem somewhat odd, yet it is so correct. You may change how you see every coin or cent you spend. You attracted to quality, value, and debating whether its a need or want. You might delay a purchase over instinct, which is a calming change, especially if you bought items over impulse.

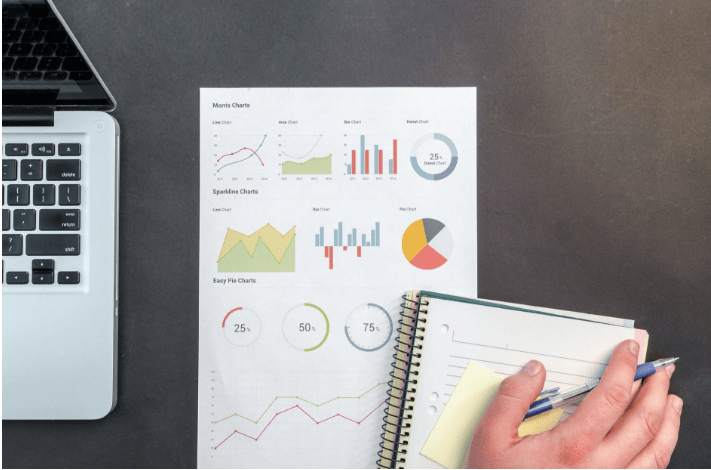

Trading is cheap. Unlike in traditional trading where brokers charge exorbitant fees, the fee charged by online brokers is much lower. If you deal with thousands of stocks, you can negotiate the broker costs. It is possible to buy and sell shares based on your degree of benefit. Besides that, you can use tools on your mobile phone to monitor your performance indicators. Additionally, there are also tools available that you can use to review your performance history.

Trading is cheap. Unlike in traditional trading where brokers charge exorbitant fees, the fee charged by online brokers is much lower. If you deal with thousands of stocks, you can negotiate the broker costs. It is possible to buy and sell shares based on your degree of benefit. Besides that, you can use tools on your mobile phone to monitor your performance indicators. Additionally, there are also tools available that you can use to review your performance history. You’re not bound when investing online to have a middleman. Online trading negates the need to have one. This procedure is hassle-free and helps in cutting away unwanted costs.

You’re not bound when investing online to have a middleman. Online trading negates the need to have one. This procedure is hassle-free and helps in cutting away unwanted costs.

If you work, buying a pension fund is only one thing. It is another habit that many professionals avoid, as they would hang up their money. When you grow up, you’ll be glad you made a decision. You will find retirement programs to choose from, so do your homework and determine which program best suits your needs. You will also need to talk to your organization about retirement options, as most companies offer a combination because curiosity comes at a cost.

If you work, buying a pension fund is only one thing. It is another habit that many professionals avoid, as they would hang up their money. When you grow up, you’ll be glad you made a decision. You will find retirement programs to choose from, so do your homework and determine which program best suits your needs. You will also need to talk to your organization about retirement options, as most companies offer a combination because curiosity comes at a cost.

After you have known your expenses, it’s about time to create your budget. When you have a plan of what you are likely to spend during a month, you should come up with a clear budget. Make sure that your budget should outline your expenses and ensure that it matches your income. When you are creating your budget, you can limit overspending. In other words, find a lot of information about making a budget.

After you have known your expenses, it’s about time to create your budget. When you have a plan of what you are likely to spend during a month, you should come up with a clear budget. Make sure that your budget should outline your expenses and ensure that it matches your income. When you are creating your budget, you can limit overspending. In other words, find a lot of information about making a budget.