Singapore is a paradise for condo lovers. From luxurious sea-facing apartments to reasonably priced riverfront homes, the city-state has something for everyone. Condos are a popular choice not only among locals but also expats who find them a convenient option for living in Singapore. If you’re one of them, you might have already started exploring condo loans to finance your dream home in Emerald of Katong or any other condo development in Singapore. If you have, register now. But of course, financing your condo might not be the easiest ride, especially if you choose a mortgage. While lenders are there to help you finance your property, they might not reveal everything you need to know about the fine print. So, before signing on the dotted line, let’s uncover what banks don’t tell you about condo loans in Singapore.

Prepayment Penalties

Prepayment penalties can catch many borrowers off guard. These fees are charged when you pay off your loan earlier than agreed. While it may seem like a good idea to eliminate debt quickly, banks often impose these penalties as a way to secure their expected interest income. The amount of the penalty varies by lender and can significantly impact your financial plans. Some lenders might charge a percentage of the remaining balance, while others have fixed amounts outlined in your loan agreement. It also means reading the fine print carefully before committing to any loan terms. Understanding how prepayment penalties work will allow you to make informed decisions about refinancing or paying down your mortgage early without incurring extra costs that could diminish savings over time.

Loan Tenure Limitations

Aside from that, loan tenure limitations can be a tricky aspect for buyers. Most banks offer tenures ranging from five to thirty years. This might sound flexible, but the choices are often more constrained than they appear. A shorter tenure means higher monthly repayments, which can strain your budget. On the flip side, longer tenures lower those payments but increase the total interest paid over time. Moreover, different lenders have varied policies based on age and retirement plans. If you’re nearing retirement age, you may face stricter limits that affect your borrowing capability.

LTV (Loan-to-Value) Restrictions

Now, let’s talk about LTV restrictions. These restrictions dictate how much you can borrow against the property’s value. Typically, for first-time homebuyers, banks allow up to 75% of the property’s purchase price or market valuation—whichever is lower. This means you’ll need a significant down payment. If you’re buying additional properties, be prepared for tighter LTV limits. The regulations tighten as you accumulate more real estate assets. This impacts your financial planning and cash flow significantly. Knowing these details upfront can prevent surprises later on. Lenders assess your financial profile before determining your specific LTV ratio. Factors like income stability and existing debts play vital roles in this evaluation process.

Lock-in Periods

Lock-in periods can also catch many condo buyers off guard. This is the time frame during which you cannot refinance or pay off your …

When it comes to tech giants, Alphabet Inc. is a name that’s hard to ignore. As the parent company of Google, this powerhouse has solidified its position as a leader in the digital realm. With innovative products and services ranging from search engines to cloud computing, Alphabet continues to shape the way we interact with technology on a daily basis. Many

When it comes to tech giants, Alphabet Inc. is a name that’s hard to ignore. As the parent company of Google, this powerhouse has solidified its position as a leader in the digital realm. With innovative products and services ranging from search engines to cloud computing, Alphabet continues to shape the way we interact with technology on a daily basis. Many  But if you’re up for some diversification games, try Mastercard (NYSE: MA). As a global payments technology company, Mastercard operates at the forefront of digital transactions. With the increasing shift towards cashless payments, Mastercard is well-positioned for growth. The company’s innovative solutions cater to both consumers and businesses alike, providing secure and seamless payment experiences. In an evolving digital landscape, Mastercard continues …

But if you’re up for some diversification games, try Mastercard (NYSE: MA). As a global payments technology company, Mastercard operates at the forefront of digital transactions. With the increasing shift towards cashless payments, Mastercard is well-positioned for growth. The company’s innovative solutions cater to both consumers and businesses alike, providing secure and seamless payment experiences. In an evolving digital landscape, Mastercard continues …

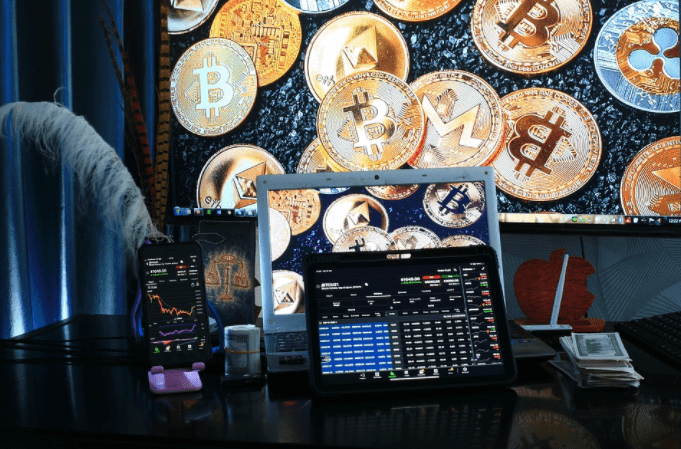

One of the most enticing aspects of investing in digital currency is the potential for high returns. Unlike traditional investments, where your gains may be gradual and limited, cryptocurrencies have shown remarkable volatility and upward momentum. The value of digital currencies can skyrocket within a short period, presenting investors with extraordinary profit opportunities. Just look at the meteoric rise of Bitcoin over the past decade – from being virtually worthless to reaching staggering heights. Investing in digital currency allows you to tap into this explosive growth potential. The decentralized nature of cryptocurrencies means that their value is not tied to any government or central authority. Instead, it relies on supply and demand dynamics within the market.

One of the most enticing aspects of investing in digital currency is the potential for high returns. Unlike traditional investments, where your gains may be gradual and limited, cryptocurrencies have shown remarkable volatility and upward momentum. The value of digital currencies can skyrocket within a short period, presenting investors with extraordinary profit opportunities. Just look at the meteoric rise of Bitcoin over the past decade – from being virtually worthless to reaching staggering heights. Investing in digital currency allows you to tap into this explosive growth potential. The decentralized nature of cryptocurrencies means that their value is not tied to any government or central authority. Instead, it relies on supply and demand dynamics within the market. Investing in digital currency offers a unique opportunity for potential portfolio diversification. With traditional investment options such as stocks, bonds, and real estate …

Investing in digital currency offers a unique opportunity for potential portfolio diversification. With traditional investment options such as stocks, bonds, and real estate …

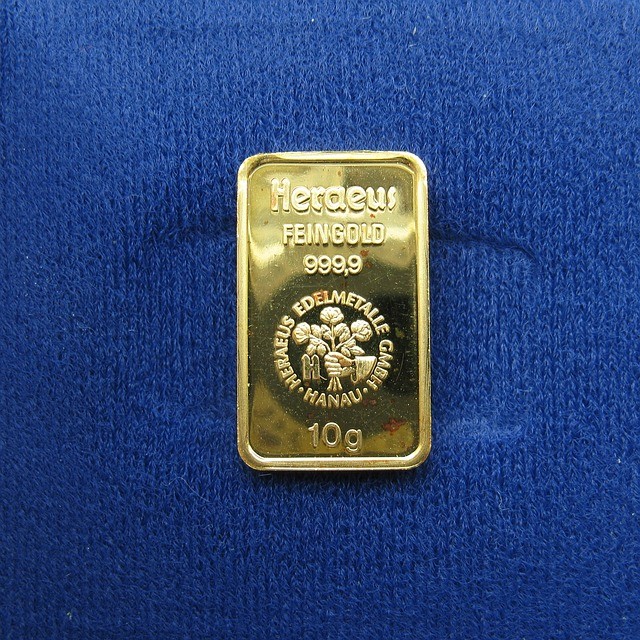

A reputable precious metals dealer should have a clearly defined buyback policy outlining the terms and conditions for selling your precious metals back to them. Evaluate the dealer’s buyback rates, fees, and procedures to ensure a fair and transparent process. Additionally, assess their customer support services, including assistance with account management, market updates, and prompt resolution of any issues that may arise. Finding a reputable dealer is key to a successful and secure transaction when investing in or selling precious metals.

A reputable precious metals dealer should have a clearly defined buyback policy outlining the terms and conditions for selling your precious metals back to them. Evaluate the dealer’s buyback rates, fees, and procedures to ensure a fair and transparent process. Additionally, assess their customer support services, including assistance with account management, market updates, and prompt resolution of any issues that may arise. Finding a reputable dealer is key to a successful and secure transaction when investing in or selling precious metals.

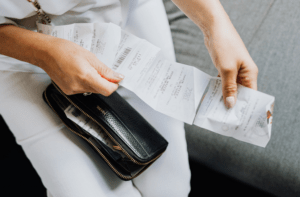

It never hurts to try negotiating your bills with service providers or creditors. You might be surprised at their willingness to work out a payment plan that fits your budget. It could save you money in the long run by avoiding expensive late fees and interest charges. In conclusion, by following these seven tips, you can prepare for unexpected expenses and rest a little easier knowing that you won’t be left scrambling for cash when the unexpected happens. Taking the time to plan will help ease financial stress in times of hardship. With careful planning and monitoring, you can ensure you are ready for anything life throws your way.…

It never hurts to try negotiating your bills with service providers or creditors. You might be surprised at their willingness to work out a payment plan that fits your budget. It could save you money in the long run by avoiding expensive late fees and interest charges. In conclusion, by following these seven tips, you can prepare for unexpected expenses and rest a little easier knowing that you won’t be left scrambling for cash when the unexpected happens. Taking the time to plan will help ease financial stress in times of hardship. With careful planning and monitoring, you can ensure you are ready for anything life throws your way.…

Finally, it is essential to maximize contributions to your

Finally, it is essential to maximize contributions to your

Lastly, taking care of home maintenance tasks regularly before listing your house is important. Make sure to keep up with routine tasks like changing the air filter, fixing any leaking pipes, and checking for pest infestations. Doing this can make your house look more appealing and help you get a higher sale price. By avoiding these mistakes, you can ensure that selling your home goes as smoothly as possible. With the right preparation and knowledge, you’ll be able to get the best sale price for your house.…

Lastly, taking care of home maintenance tasks regularly before listing your house is important. Make sure to keep up with routine tasks like changing the air filter, fixing any leaking pipes, and checking for pest infestations. Doing this can make your house look more appealing and help you get a higher sale price. By avoiding these mistakes, you can ensure that selling your home goes as smoothly as possible. With the right preparation and knowledge, you’ll be able to get the best sale price for your house.…

With a secured auto loan, the purchased car acts as collateral for the loan. This means that if you fail to make payments, the lender can repossess your vehicle.

With a secured auto loan, the purchased car acts as collateral for the loan. This means that if you fail to make payments, the lender can repossess your vehicle. But what if you want to purchase a car but have bad credit or no credit? That’s where car title loans come in. These auto loans use the vehicle purchased as collateral, just like a secured loan. However, they also require you to hand over the title of your car during the duration of the loan. If you default on the loan, the lender can repossess and sell your car to cover the remaining balance. Be wary of car title loans as they often come with high-interest rates and short terms, making them a risky option for financing a vehicle.

But what if you want to purchase a car but have bad credit or no credit? That’s where car title loans come in. These auto loans use the vehicle purchased as collateral, just like a secured loan. However, they also require you to hand over the title of your car during the duration of the loan. If you default on the loan, the lender can repossess and sell your car to cover the remaining balance. Be wary of car title loans as they often come with high-interest rates and short terms, making them a risky option for financing a vehicle.

If you want to prepare and nail a business tax audit, it’s best to keep meticulous records of all your business expenses. It includes everything from office supplies and equipment to travel and entertainment. If you can’t produce receipts or documentation for a particular payment, the IRS may disallow it. To make sure you’re keeping accurate records, set up a system for tracking expenses as they occur. It can be as simple as creating a folder on your computer or using an app like Expensify.

If you want to prepare and nail a business tax audit, it’s best to keep meticulous records of all your business expenses. It includes everything from office supplies and equipment to travel and entertainment. If you can’t produce receipts or documentation for a particular payment, the IRS may disallow it. To make sure you’re keeping accurate records, set up a system for tracking expenses as they occur. It can be as simple as creating a folder on your computer or using an app like Expensify. The last thing you want from a tax audit is that the IRS can’t understand your financial records well, leading to misunderstanding. So, it’s crucial to organize your records in an easy-to-read format. This way, the IRS can quickly identify what they need and move on with the audit process. One way to do this is to create a spreadsheet that lists all of your business expenses. You can also use accounting software like QuickBooks or FreshBooks. Or even better, you can hire a professional accountant to do it for you.

The last thing you want from a tax audit is that the IRS can’t understand your financial records well, leading to misunderstanding. So, it’s crucial to organize your records in an easy-to-read format. This way, the IRS can quickly identify what they need and move on with the audit process. One way to do this is to create a spreadsheet that lists all of your business expenses. You can also use accounting software like QuickBooks or FreshBooks. Or even better, you can hire a professional accountant to do it for you.

Once you know your credit score, you can start shopping for the best interest rates. There are a few ways to do this. You can use an online loan calculator to compare rates from different lenders.

Once you know your credit score, you can start shopping for the best interest rates. There are a few ways to do this. You can use an online loan calculator to compare rates from different lenders.

According to the above study, the average household owes over $130,000 in debt. It can be a major cause of stress for families. If you’re considering taking on any kind of debt, it’s vital to understand the implications and make sure you can handle the payments. If you’re struggling with debt, resources are available to help you get back on track. The most important thing is to stay informed and make a plan that works for your family.

According to the above study, the average household owes over $130,000 in debt. It can be a major cause of stress for families. If you’re considering taking on any kind of debt, it’s vital to understand the implications and make sure you can handle the payments. If you’re struggling with debt, resources are available to help you get back on track. The most important thing is to stay informed and make a plan that works for your family. Before taking on any debt, it’s important to understand the implications. They include understanding the interest rates, repayment terms, and your overall financial picture. You can use tools like a debt calculator to help you understand the implications of taking on debt. It can be a helpful way to see how much your payments will be and how long it will take you to pay off the debt. It’s also important to remember that household debt is not just about the money you owe. It’s also about your credit score and your ability to get loans in the future.

Before taking on any debt, it’s important to understand the implications. They include understanding the interest rates, repayment terms, and your overall financial picture. You can use tools like a debt calculator to help you understand the implications of taking on debt. It can be a helpful way to see how much your payments will be and how long it will take you to pay off the debt. It’s also important to remember that household debt is not just about the money you owe. It’s also about your credit score and your ability to get loans in the future. Not all debt is created equal. There are different types of household debt, and each has its own set of implications. The most common types of household debt are mortgage debt, student loan debt, and credit card debt. Mortgage debt is usually the largest type of debt that families have. This debt is typically spread out over a long period, and it usually has lower interest rates. Student loan debt is another common type of debt, and it can be difficult to repay if you don’t have a steady income. Credit card debt is often the most expensive type of debt, and it can be easy to get into if you’re not careful.

Not all debt is created equal. There are different types of household debt, and each has its own set of implications. The most common types of household debt are mortgage debt, student loan debt, and credit card debt. Mortgage debt is usually the largest type of debt that families have. This debt is typically spread out over a long period, and it usually has lower interest rates. Student loan debt is another common type of debt, and it can be difficult to repay if you don’t have a steady income. Credit card debt is often the most expensive type of debt, and it can be easy to get into if you’re not careful.

Another thing you can do to manage your finances as a fashion blogger is to track your expenses. It includes both your income and your spending. By following your costs, you will see where you are spending the most money and make adjustments accordingly. There are many ways to track your expenses, but a straightforward method is to use a spreadsheet or budgeting app. It will help you see where your money is going and make changes to ensure that you are not overspending.

Another thing you can do to manage your finances as a fashion blogger is to track your expenses. It includes both your income and your spending. By following your costs, you will see where you are spending the most money and make adjustments accordingly. There are many ways to track your expenses, but a straightforward method is to use a spreadsheet or budgeting app. It will help you see where your money is going and make changes to ensure that you are not overspending.

These days, everything relies on your credit score. Your credit score is a three-digit number that lenders use to determine the risk of lending you the funds. The higher your score, the lower the risk for the lender, and the more likely you are to get approved for a loan. You can do a few things to improve your credit score, including paying your bills on time, maintaining a low credit utilization ratio, and avoiding applying for too many loans at once.

These days, everything relies on your credit score. Your credit score is a three-digit number that lenders use to determine the risk of lending you the funds. The higher your score, the lower the risk for the lender, and the more likely you are to get approved for a loan. You can do a few things to improve your credit score, including paying your bills on time, maintaining a low credit utilization ratio, and avoiding applying for too many loans at once. If you have a history of irresponsible borrowing and spending, it’s going to be tough to get approved for a loan. Lenders want to know that you’re capable of managing your debt and that you won’t default on your loan payments. There are a few things you can do to improve your chances of getting approved for a loan, including paying your bills on time, maintaining a low credit utilization ratio, and avoiding applying for too many loans at once.

If you have a history of irresponsible borrowing and spending, it’s going to be tough to get approved for a loan. Lenders want to know that you’re capable of managing your debt and that you won’t default on your loan payments. There are a few things you can do to improve your chances of getting approved for a loan, including paying your bills on time, maintaining a low credit utilization ratio, and avoiding applying for too many loans at once.

This is probably the essential thing you can do when it comes to stock trading. Ensure you know what you’re investing in and understand the risks involved.

This is probably the essential thing you can do when it comes to stock trading. Ensure you know what you’re investing in and understand the risks involved. Don’t put all of your eggs in one basket. Diversify your portfolio by investing in a variety of stocks. This will help protect you from any sudden drops in the market. You don’t want to lose all your money if one company goes bankrupt.

Don’t put all of your eggs in one basket. Diversify your portfolio by investing in a variety of stocks. This will help protect you from any sudden drops in the market. You don’t want to lose all your money if one company goes bankrupt.

It is critical to consider the selection of cryptos offered by the exchange. Some only offer a limited number of cryptocurrencies, while others dozens or even hundreds. If you are looking for a specific cryptocurrency, ensure that the exchange provides it. Additionally, you want to establish the exchange’s security. This includes things like two-factor authentication, SSL encryption, and cold storage.

It is critical to consider the selection of cryptos offered by the exchange. Some only offer a limited number of cryptocurrencies, while others dozens or even hundreds. If you are looking for a specific cryptocurrency, ensure that the exchange provides it. Additionally, you want to establish the exchange’s security. This includes things like two-factor authentication, SSL encryption, and cold storage. Some exchanges allow you to buy cryptocurrencies with fiat currency, while others only trade cryptos with other cryptos. If you want to buy Bitcoin and Ethereum with USD, then make sure the exchange offers that option. The last thing you want to look for is the exchange’s trading fees. Some exchanges charge higher fees than others, so make sure that if they have a lower fee structure, then there are no other hidden charges involved with using their service.

Some exchanges allow you to buy cryptocurrencies with fiat currency, while others only trade cryptos with other cryptos. If you want to buy Bitcoin and Ethereum with USD, then make sure the exchange offers that option. The last thing you want to look for is the exchange’s trading fees. Some exchanges charge higher fees than others, so make sure that if they have a lower fee structure, then there are no other hidden charges involved with using their service.

One of the most common money mistakes expectant parents make is not having an emergency fund. If you plan to have children, you must start saving up for emergencies right away.

One of the most common money mistakes expectant parents make is not having an emergency fund. If you plan to have children, you must start saving up for emergencies right away. A common mistake with expectant parents is buying things they don’t need. After finding out that you’re pregnant, it’s essential to take a step back and look at how much all these new baby items will cost before running off purchasing them all.

A common mistake with expectant parents is buying things they don’t need. After finding out that you’re pregnant, it’s essential to take a step back and look at how much all these new baby items will cost before running off purchasing them all.

When you invest in a gold IRA, your money is diversified among many different types of assets. This means it will be much less likely to lose value when the market dips or tanks. Gold is one of these asset classes, and its price tends to rise even during recessions because people turn to it as an alternative source of financial security.

When you invest in a gold IRA, your money is diversified among many different types of assets. This means it will be much less likely to lose value when the market dips or tanks. Gold is one of these asset classes, and its price tends to rise even during recessions because people turn to it as an alternative source of financial security. Since you can transfer funds from your traditional IRA into your gold IRA, it is very easy to avoid …

Since you can transfer funds from your traditional IRA into your gold IRA, it is very easy to avoid …

Don’t forget about the little ones in your life, be sure to include them on your list of people you need to buy for this holiday season. Include some special gifts that’ll make their eyes light up, just like when they open presents with all their family around.

Don’t forget about the little ones in your life, be sure to include them on your list of people you need to buy for this holiday season. Include some special gifts that’ll make their eyes light up, just like when they open presents with all their family around.

There’s always a hot tip or a sure thing in cryptocurrencies. Block X has assembled a team of industry experts dedicated to finding the best investment opportunities. You can create your due diligence checklist if you want to invest in cryptocurrencies on your own. Does the team exist? Check their LinkedIn presence to make sure they are a legitimate and experienced player in the cryptocurrency space.

There’s always a hot tip or a sure thing in cryptocurrencies. Block X has assembled a team of industry experts dedicated to finding the best investment opportunities. You can create your due diligence checklist if you want to invest in cryptocurrencies on your own. Does the team exist? Check their LinkedIn presence to make sure they are a legitimate and experienced player in the cryptocurrency space.

When you are involved in the accident and when it is concluded that it took place before your negligence, the liability coverage can rescue you. The term liability refers to insurance that provides an insured party with protection against claims resulting from injuries and damage to other people or property. This level is the minimum you may need as a legally insured driver.

When you are involved in the accident and when it is concluded that it took place before your negligence, the liability coverage can rescue you. The term liability refers to insurance that provides an insured party with protection against claims resulting from injuries and damage to other people or property. This level is the minimum you may need as a legally insured driver.

When you ask your daughter what she needs for Christmas, have her put it in order of preference. Just because something is on the list, doesn’t mean you have to buy it for them. If you have 20 things on the list, make sure they are placed according to your taste. This is also one mistake that many parents do that is why they go over their budget at times.

When you ask your daughter what she needs for Christmas, have her put it in order of preference. Just because something is on the list, doesn’t mean you have to buy it for them. If you have 20 things on the list, make sure they are placed according to your taste. This is also one mistake that many parents do that is why they go over their budget at times.

You should make sure you keep track of where your money goes, comes in, and how much you spend on it. There are several unique ways to do this. If you only have a few trades per month, then you probably need to create a concise group in the format that suits you best. You can also purchase a ledger and record your accounts the traditional way on paper. You can purchase specialized accounting software, but if you’re a small business with a few trades, it’s probably not worth it.

You should make sure you keep track of where your money goes, comes in, and how much you spend on it. There are several unique ways to do this. If you only have a few trades per month, then you probably need to create a concise group in the format that suits you best. You can also purchase a ledger and record your accounts the traditional way on paper. You can purchase specialized accounting software, but if you’re a small business with a few trades, it’s probably not worth it. Each year, nearly eight out of ten people receive a federal tax refund, and, according to the IRS, the average amount paid is almost $3,000. Many feel happy to understand that the money is going into their bank accounts because they have big plans to spend it. However, receiving this refund ensures that they have kept about $3,000 from their paychecks throughout the year.

Each year, nearly eight out of ten people receive a federal tax refund, and, according to the IRS, the average amount paid is almost $3,000. Many feel happy to understand that the money is going into their bank accounts because they have big plans to spend it. However, receiving this refund ensures that they have kept about $3,000 from their paychecks throughout the year. If you entered deductions when you prepared your tax return, check your return to make sure you could take the full deduction this tax year. Occasionally, you may have received little or no deduction benefit due to income restrictions. For example, if you have a rented apartment, you may have had to take a deduction for your loss, such as depreciation. The same applies to some education loans. Evaluate your investment performance to see if you have any deductions left over for these reasons. You may need them next year if your

If you entered deductions when you prepared your tax return, check your return to make sure you could take the full deduction this tax year. Occasionally, you may have received little or no deduction benefit due to income restrictions. For example, if you have a rented apartment, you may have had to take a deduction for your loss, such as depreciation. The same applies to some education loans. Evaluate your investment performance to see if you have any deductions left over for these reasons. You may need them next year if your

A large number of people have several reasons to

A large number of people have several reasons to  Sometimes it is difficult to meet your personal needs with all the money available; in such circumstances, private loans can provide the cash you need. However, be sure to use the amount in the best possible way, since you have to pay out of curiosity. It is not usual to get a personal loan. This means that you do not need to provide collateral when taking out a loan. The lender offers you the loan based on your creditworthiness and qualifications. You will be easily approved for the loan if you have a good credit rating. You may also be offered a lower interest rate.

Sometimes it is difficult to meet your personal needs with all the money available; in such circumstances, private loans can provide the cash you need. However, be sure to use the amount in the best possible way, since you have to pay out of curiosity. It is not usual to get a personal loan. This means that you do not need to provide collateral when taking out a loan. The lender offers you the loan based on your creditworthiness and qualifications. You will be easily approved for the loan if you have a good credit rating. You may also be offered a lower interest rate.

A day

A day  A swing trader is a person who’s on the lookout for more significant motions on the marketplace and their transactions can endure for a day, a couple of days or even a few weeks. Together with the reduced cycle of transactions, you will find fewer commissions, less prospect of error, as well as also the capacity to catch the significant multi-day gains of swing trading. Technical evaluation is typically utilized to identify swing trading opportunities and they aim for a more considerable proportion of yield than daily trading. Together with the greater profit goals also comes a greater risk per transaction. Suppose you’re seeking to exchange over a longer duration. Besides, you have overnight dangers and you’re subjected to some significant events or developments.

A swing trader is a person who’s on the lookout for more significant motions on the marketplace and their transactions can endure for a day, a couple of days or even a few weeks. Together with the reduced cycle of transactions, you will find fewer commissions, less prospect of error, as well as also the capacity to catch the significant multi-day gains of swing trading. Technical evaluation is typically utilized to identify swing trading opportunities and they aim for a more considerable proportion of yield than daily trading. Together with the greater profit goals also comes a greater risk per transaction. Suppose you’re seeking to exchange over a longer duration. Besides, you have overnight dangers and you’re subjected to some significant events or developments.